You’ll recall that the Geospatial Commission published a narrative report about the ethics of location data a few months ago (more here and here). They’ve now issued an Excel spreadsheet containing the data upon which their report findings were based (more here).

There are four findings in these survey statistics that insurers need to take note of. Some relate to issues, while others relate to sectors.

Key Finding 1 – The Uncertain Middle

Their key finding is that the UK public’s trust in the use of location data differs greatly according to who is putting it to use. So the public have a lot of trust in how emergency services use location data, but very little trust in how social media organisations use it. How does insurance stand then? It falls within the ‘banking and financial institutions’ category and its performance in relation to the other seven type of organisations is shown below.

|

How much

trust, if any, do you have in each of the following types of organisation to

use your location data responsibly? |

||

|

The Eight

Type of Organisations |

Great Deal / Fair Amount of Trust |

Not Very Much / No Trust |

|

Emergency

services |

80% |

9% |

|

Banks and

financial institutions |

40% |

46% |

|

Telecoms

companies (e.g. O2, Vodafone and EE) |

31% |

56% |

|

Local

council |

35% |

51% |

|

UK

government |

29% |

58% |

|

Social media

platforms (e.g. Twitter, TikTok etc) |

9% |

79% |

|

National

companies (e.g. Amazon, Tesco, Google etc) |

22% |

65% |

|

Local

companies (e.g. an independent company) |

23% |

56% |

What this table says us is that outwith of the two outliers (emergency services and social media platforms), public attitudes lean towards being mistrustful of how their location data is being used. That said, the ‘banking and financial institutions’ category comes out best in that middle group. However, a word of warning. It is a pretty broad category covering many scenarios in how location data would be used.

Key Finding 2 – Misunderstandings

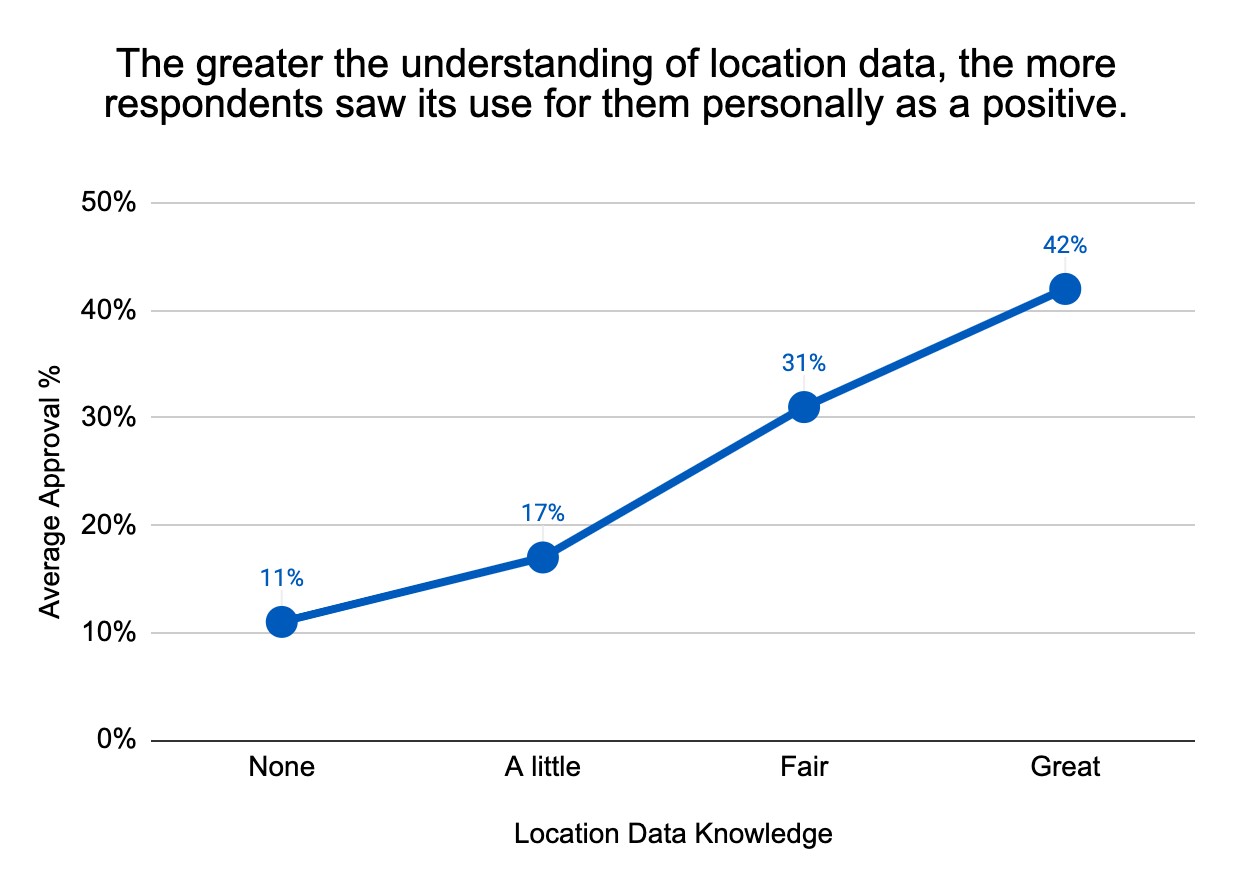

Another key finding is that organisations can build trust by engaging with the public on how they use location data.

What this graph also contains is a word of warning. Even when the public’s knowledge of how location data is used is ‘great’, the average approval percentage is still only 42%. So there seems to be two phases of engagement – one to remove misunderstandings (the 11% to 42% phase) and another to address concerns (the over 42% phase).

Key Finding 3 – Consent Again

So what sort of concerns need to be engaged with?

|

How much

of a risk do you perceive the following to be in relation to the use of

location data? |

|||

|

The Six Context

Questions |

Major /

Significant Risk |

Moderate

Risk |

Minor / No

Risk |

|

Data being

stolen by cybercriminals |

57% |

22% |

8% |

|

Organisations

using location data without consent |

64% |

19% |

7% |

|

Decisions

made using data not considering people not sharing location data |

47% |

23% |

9% |

|

People’s

personal privacy being reduced |

60% |

20% |

9% |

|

Data being

used in a way that unknowingly favours a group/organisation |

62% |

18% |

6% |

What this table tells us is that consent is the public’s main concern in relation to location data. I interpret this as reflecting the public’s concern about consent in general, of which location data is just one of several types of data that the concern exists in relation to.

The next biggest concern tells us that even when consent is present, the public fear that the organisation will use data not in the public’s interest, but in their own interests. Now, to an extent, I think this is pretty much ‘just life’. Organisations will collect data for their own interests. What they need to do more on is evidence how that data use does actually benefit the customer too. And I emphasise ‘evidencing’ and ‘actually benefit’!

Key Finding 4 – Identifiable Data

The extent to which location data can identify someone is also a concern for insurers to note.

|

How

acceptable or unacceptable do you think it is for organisations to collect

and analyse data about you? |

||

|

The Two

Response Questions |

Always / Mostly Acceptable |

Mostly / Always Unacceptable |

|

When it

identifies you? |

14% |

72% |

|

When it is

anonymised, and does not identify you? |

56% |

30% |

What this table signals to us is that insurers’ interest in identifiable data runs pretty counter to the public’s interest in location data being anonymised. And even when it is anonymised, there’s clearly scepticism around just how effective that anonymisation will be.

Lessons Here for Insurers

Let’s weigh up some lessons that insurers can draw from this survey data.

Firstly, I think that the sector needs to move forward on data ethics in general (not just location data) by addressing both the misunderstandings and the concerns. The two will of course have to be handled in different ways. Most importantly (times ten!), both those misunderstandings and those concerns need to be orientated around the public’s views, not the sector’s views. Out of that work will come things that the sector is willing and able to do, things that will have to be negotiated, and things that the sector will feel unable to do. Sure, this doesn’t result in public concerns going away, but at least it clears some of the ‘addressable’ stuff out of the way.

Secondly, this initiative by the Geospatial Commission seems to me to be an admirable example of how the sector could start addressing the serious concerns for insurers identified in the independent research commissioned in 2019 by the ABI and published in February 2020 (more here). By conducting a similar research programme, those misunderstandings, concerns, negotiables, red lines etc can be clarified and where possible, addressed. It would be a real pity if that ABI research was left to stagnate.

And thirdly, there is within that ‘banking and financial institutions’ category, signals that the public recognises the need for firms in that category to do things with location data specifically, and data in general. There are foundations there for firms to build upon. That said, those foundations are premised on the public’s views on insurers’ use of location data being similar to those of other firms in that overall category. And that is not a premise that an initiative should be built upon – it’s too broad. It’s a category that needs to be unpicked by sector.

Summing Up

Location data feels to me like a ‘rolling stone ready to gather moss’. Set it off and as it does along, all sorts of other things are picked up. Insurance wise, I’m thinking of motor, household, travel, health and life for a start. I’m thinking of marketing, underwriting, claims and counter-fraud. And then there’s the commercial market as well.

What is almost unique about insurance is that what it gets out of location data is so much more than just location. It can tell the insurer things about your life and character, both today and in the near future. And the insurer can respond through cover, premium and terms.

And in such circumstances, thinking on the one hand from a public perspective, and on the other hand from an investor perspective, it would seem to make sense for insurers to pro-actively engage with the public on location data, in order to remove misunderstandings and address the concerns that undermine trust. Sure, it’s not a small task, but then, neither is a digital transformation.